Draft budget 2026

Draft budget 2026

The draft budget for 2026 was presented to the Beckum City Council on 17 December 2025.

Key data of the 2026 draft budget

Profit plan

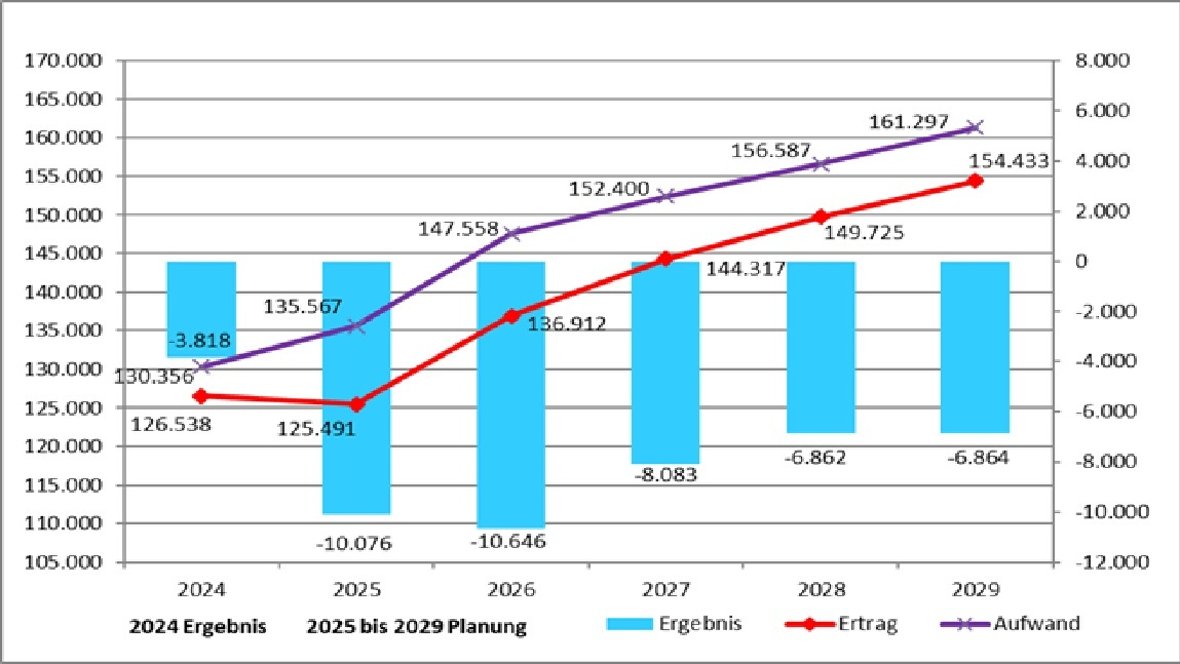

The development of income and expenses consistently shows a negative annual result. The planned annual results are -10,645,950 euros in 2026, -8,083,050 euros in 2027, -6,861,650 euros in 2028 and -6,864,150 euros in 2029.

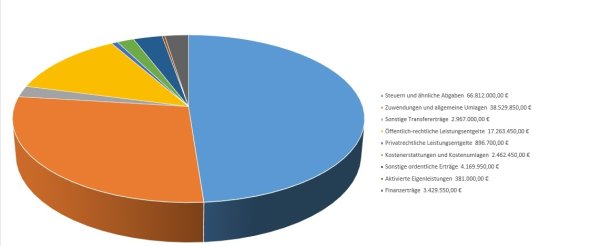

Income and expenses in the 2026 budget

| Approach 2026 Euro | Approach 2027 Euro | Approach 2028 Euro | Approach 2029 Euro | |

| Income | 136.911.950 | 144.316.850 | 149.725.250 | 154.433.050 |

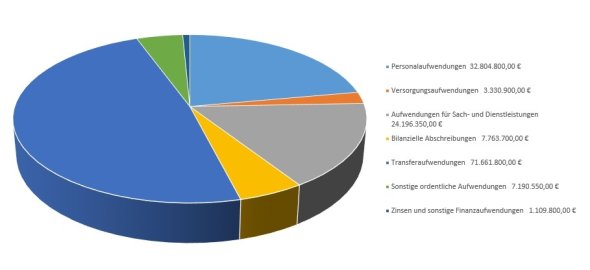

| Expenses | 148.057.900 | 152.899.900 | 157.086.900 | 161.797.200 |

| Global reduction in expenses | 500.000 | 500.000 | 500.000 | 500.000 |

| Annual result | -10.645.950 | -8.083.050 | -6.861.650 | -6.864.150 |

Income and expenses in the 2026 budget

Financial planning

| Approach 2026 Euro | Approach 2027 Euro | Approach 2028 Euro | Approach 2029 Euro | |

| Cash inflow from operating activities | 129.751.650 | 137.259.000 | 141.474.700 | 145.247.400 |

| Cash outflow from current administrative activities | 136.197.350 | 140.615.750 | 144.584.000 | 148.157.100 |

| Balance from current administrative activities | -6.445.700 | -3.356.750 | -3.109.300 | -2.909.700 |

| Cash inflow from investing activities | 19.714.700 | 15.294.650 | 14.907.050 | 13.691.250 |

| Cash outflow from investing activities | 46.250.000 | 48.774.150 | 59.002.400 | 38.708.500 |

| Balance from investment activity | -26.535.300 | -33.479.500 | -44.095.350 | -25.017.250 |

| Cash inflow from financing activities | 33.526.050 | 38.034.050 | 49.260.750 | 30.514.400 |

| Cash outflow from financing activities | 545.050 | 1.197.800 | 2.056.100 | 2.587.450 |

| Balance from financing activities | 32.981.000 | 36.836.250 | 47.204.650 | 27.926.950 |

| Change in the stock of own financial resources | 0 | 0 | 0 | 0 |

| Opening balance of financial resources | 0 | 0 | 0 | 0 |

| Cash and cash equivalents | 0 | 0 | 0 | 0 |

Tax rates

| 2025 | 2026 | |

| Trade tax | 435 % | 430 % |

| Property tax A | 331 % | 331 % |

| Property tax B -N- from 2025 | 1.110 % | 1.110 % |

| Property tax B -W- from 2025 | 607 % | 607 % |